Introduction

Hidden fees and unexpected costs have become an unfortunate reality wherever consumers turn. From food delivery to concert tickets to lodging, the White House estimates that Americans are spending more than $65 billion on fees each year

Hidden fees and unexpected costs have become an unfortunate reality wherever consumers turn. From food delivery to concert tickets to lodging, the White House estimates that Americans are spending more than $65 billion on fees each year

The Most Popular Vehicle Programs

There are four main vehicle programs most companies use:

- Company-provided vehicle

- Car Allowance

- Cents-per-mile Reimbursement

- Fixed and Variable Rate (FAVR) Reimbursement

Today, rather than deploy a single, prescriptive program across the entire driving

workforce, most companies use more than one of these vehicle programs simultaneously.

One-by-one, we’ll break down the true costs of each solution, starting with the most

expensive option: Company-Provided Vehicle Programs.

The Total Cost of a Company-Provided Vehicle

Also referred to as a fleet program, this model calls on employers to either purchase or lease vehicles for their employees to drive. From the jump, that’s a considerable amount of overhead. Unfortunately, there are significant additional costs businesses aren’t aware of when they sign up for company-provided vehicles. Those costs include:

- Fuel Cards

To pay for business mileage, companies provide employees with prepaid debit or credit cards specifically for fuel or gas. Unfortunately, there’s no easy way to track whether employees are using gas cards for business or personal trips

- Vehicle Maintenance

When a company has a fleet of vehicles, they’re responsible for general upkeep, in addition to repairs following accidents and storing vehicles when turnover occurs.

- Liability

In 2019, traffic accidents cost employers $72.2 billion. In the event of an accident, the situation is worse with fleet vehicles. Fleet vehicles are owned by the company, meaning that if an employee driving one is found at fault in an auto accident, the company becomes a target.

Businesses signing up for fleet will see an initial price tag, one that doesn’t consider the support costs. A fleet program will also often require a full-time hire or an outsourced effort to manage. On average, fleets cost companies $12,816 per driver.

On average, fleets cost companies $12,816 per driver.

The Total Cost of a Car Allowance

Also referred to as an auto allowance or vehicle allowance, under this model, companies provide employees with a flat stipend each month. Businesses like this program for a number of reasons: First, when the payment is the same each month, it’s easy to budget for. Second, it doesn’t take much effort to set up, and is mostly hands off once a rate is established. But with that ease comes a mountain of issues, including:

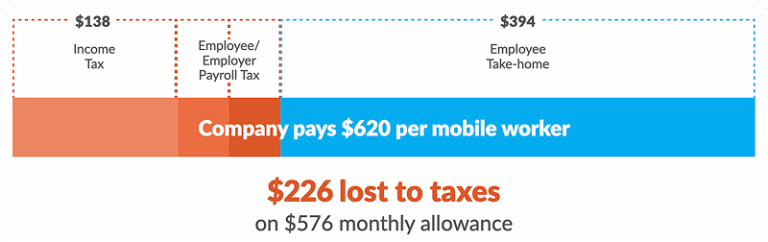

- Tax Waste

Because a car allowance isn’t substantiated by mileage logs, the IRS considers it additional income. That means the company pays more and employees receive less.

- Disengaged Employees

Everyone receiving the same stipend may seem fair, but $575 goes a lot further in a region with lower gas prices. Employees driving in high fuel cost areas will go through that stipend a lot quicker than other mobile workers. When they do, they lack incentive to continue driving and paying out-of-pocket for gas.

- Fuel Cards

Some companies with car allowances end up finding their stipends are insufficient. To fix this issue, they provide driving employees with fuel cards. The result of this is ballooning gas spend with little to no insight into actual use.

Companies using a car allowance find it easy to focus on the ease of implementation and administration. However, the cost in tax waste, disengaged employees and fuel cards should not be overlooked.

The Total Cost of Cents-Per-Mile Reimbursement

Also referred to as simply Mileage Reimbursement, Cents-Per-Mile (CPM) programs let companies pay employees a flat rate per business mile driven. With this method, companies commonly use the IRS mileage reimbursement rate, as it guarantees tax-free reimbursements. But even using the IRS rate comes with unexpected costs, including:

- Mileage Fraud

When companies rely on employees to manually record their mileage–opposed to an automated mileage tracking app–it’s common for incorrect travel logs to impact reimbursement. Rounding up cents on each trip may seem harmless enough, but multiplied across the mobile workforce? That number can explode.

- Audit Exposure

Another issue with typical CPM programs is the manual process. Employees submitting mileage scribbled down on random scraps of paper might not have all the necessary information. This can expose both them and your company to an IRS audit.

- High-Mileage Drivers

Mileage reimbursements are ideal for mobile workers who drive around 5,000 miles or less annually and work in the same general region. High-mileage employees, on the other hand, who exceed the 5,000-mile threshold are prone to being over-reimbursed as minor roundups and even inadvertent mileage fraud pile up.To pay for business mileage, companies provide employees with prepaid debit or credit cards specifically for fuel or gas. Unfortunately, there’s no easy way to track whether employees are using gas cards for business or personal trips

- Unpredictable Reimbursements

Because a CPM reimbursement is based on an employee’s mileage trends, it’s difficult to budget ahead for employees with fluctuating commutes or schedules.

Companies using CPM might find it easy to set the new rate each year. Unfortunately, that leaves many exposed to mileage fraud, audit risk and at the whim of their highmileage drivers. That isn’t to say CPM programs don’t have a place.

Businesses with lower mileage drivers in the same general area can benefit from the simplicity of a mileage reimbursement program. Provided they use an automated mileage capture app to reduce mileage fraud and audit exposure, CPM can be a great reimbursement for both company and employee. For the companies that don’t fit that criteria, the cost of mileage reimbursement can be too high.

The Total Cost of Fixed and Variable Rate (FAVR) Reimbursement

Companies use a fixed and variable rate (FAVR) reimbursement for a number of reasons related to the many flaws found in the other standalone offerings. FAVR reimbursements pay for the fixed and variable costs of owning and operating a vehicle. These reimbursements are tax-free, specific to employees’ geographic costs and submitted through an IRS-compliant mileage capture app. There are, of course, some shortcomings including:

- Business Mileage Floor

Employees must drive a minimum of 5,000 miles each year to qualify for FAVR reimbursement.

- Complexity

There’s notably more to account for with a FAVR program than more straightforward tactics. Fortunately, the right vendor can simplify a lot of that complexity.

While FAVR might not be for every company, with the right vendor, it’s a program that offers the most.

Using Multiple Vehicle Programs

More often than not, different employee driver profiles will require different kinds of vehicle programs. This poses the following considerations for employees tasked with managing these programs, including:

- Administrators must know which employee are a part of what vehicle program, what rate each employee receives and the rules each program must follow.

- With so many moving parts, things can easily get mixed up and put strain on the administrator tasked with management.

- Companies may also have safety programs or other vehicle program initiatives that require administrative lift.

What options does a company have when tackling this challenge?

One Partner for Comprehensive Vehicle Program Management

It’s typical for companies to look to experts for support in managing their vehicle programs. While one vendor may help with company mileage reimbursement, another may focus on specifically on car allowances. All of this is to drive home the point that not every vendor is equipped to support multiple vehicle programs, let alone simultaneously. Fortunately, Motus can prevent that.

Motus is the industry leader in reimbursement for a reason. With decades of experience across reimbursement types, areas and industries, our comprehensive platform supports multiple vehicle programs simultaneously. Whether it’s automating mileage capture or calculating accurate rates, sharing insight into your mobile workforce or ensuring IRS-compliant mileage logs, Motus is here to help if you want to use one or more vehicle programs.